Trade Tax in Germany:

What is it, and who has to pay it?

What is trade tax, and which types of businesses are subject to it?

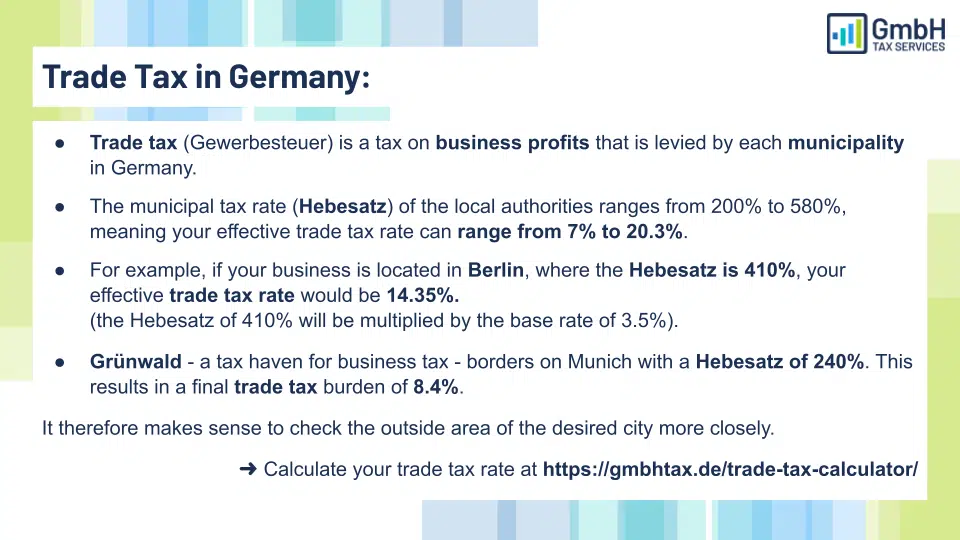

Trade tax is a tax on business profits that is levied by each municipality in Germany. It differs from income tax and corporation tax, which are federal taxes that apply to all individuals and corporations.

Trade tax is paid by all commercial businesses in industry, trade, crafts, and services, regardless of their legal form or size. However, some exemptions or reductions exist for certain types of businesses or activities, such as agriculture, forestry, public utilities, non-profit organizations, etc.

How it differs from income tax and corporation tax

The base rate and the municipal multiplier determine the trade tax rate. The base rate is 3.5% across Germany, while the municipal multiplier (Hebesatz) varies from one municipality to another and can range from 200% to 580%.

The entire profit for trade tax purposes is calculated by adjusting the profit for corporation tax with certain statutory additions and allowances.

Which types of businesses are subject to it

Sole proprietorships and partnerships can claim a tax credit for trade tax paid against their income tax liability. This means that they can deduct part or all of their trade tax paid from their income tax payable.

The credit amount depends on several factors, such as the profit, the trade tax rate, and the personal income tax rate.

Corporations cannot claim this credit and must pay both trade and corporation taxes on their entire profit. However, they can deduct a portion of their trade tax paid as a business expense.

How is trade tax calculated, and what factors affect it?

To calculate trade tax, you need to determine your profit for trade tax purposes, which differs from your taxable income for corporation or income tax purposes. You must make certain statutory additions and allowances to your profit for corporation tax purposes, such as adding back 25% of your financing costs over 200,000 euros, deducting a portion of your dividends from other corporations, etc.

Examples of different trade tax rates in different municipalities and how they compare to other countries.

The taxable profit for trade tax purposes is multiplied by the base rate of 3.5%, resulting in the tax base amount. The tax base amount is then multiplied by the municipal multiplier (Hebesatz), which varies depending on your business’s location.

The municipal tax rate (Hebesatz) of the local authorities ranges from 200% to 580%, meaning your effective trade tax rate can range from 7% to 20.3%.

For example, if your business is located in Berlin, where the Hebesatz is 410%, your effective trade tax rate would be 14.35% (the Hebesatz of 410% will be multiplied by the base rate of 3.5%).

Grünwald – a tax haven for business tax – borders on Munich with a Hebesatz of 240 %. This results in a final trade tax burden of 8.4%. It therefore makes sense to check the outside area of the desired city more closely.

Use our free trade tax calculator to determine your effective trade tax rate. Alternatively, refer to our corporate tax calculator to estimate the total tax burden of your business.

How can sole proprietorships and partnerships claim a tax credit for trade tax paid?

The trade tax rates in Germany are generally higher than those in other countries, such as France (0.16%), Italy (3.9%), or Spain (1.1%). However, sole proprietorships and partnerships can claim partial or full credit for trade tax paid against their personal tax liability. This means they can reduce their income tax payable by deducting part or all of their trade tax paid from their profit.

The credit amount depends on several factors, such as profit, their personal income tax rate, and their trade tax rate. Some conditions and limitations for claiming this credit include a minimum threshold of the taxable profit (24,500 euros), a maximum credit amount per euro of trade tax paid (3.8%), etc. To calculate the credit amount, you must apply a formula considering these factors.

You can use our Trade Tax Calculator to determine your trade tax burden.

How is trade tax paid and reported?

When and how to make tax prepayments, annual returns, final assessments, adjustments, refunds, etc.

Register your business with the municipality (Gemeinde) and obtain a trade tax identification number (Gewerbesteuernummer) to pay a trade tax.

You must also file a trade tax declaration (Gewerbesteuererklärung) every year, along with your profit or corporation tax declaration and forward it to the municipality.

The deadline for filing your trade tax declaration is usually July 31 of the following year unless you use a tax advisor or an extension is granted.

What are the deadlines, penalties, interest rates, etc., for late or incorrect payments or filings?

Based on your trade tax declaration, the local tax office will issue a trade tax assessment (Gewerbesteuerbescheid) to state how much trade tax you owe for the year. You must also make advance tax prepayments (Vorauszahlungen) of trade tax every quarter based on your estimated profit for the year.

The tax prepayments are due each year on February 15, May 15, August 15, and November 15. The advance payment amount is calculated by your previous year’s trade tax assessment or your own estimate if you are a new business. The final amount of trade tax due will be adjusted after you file your annual declaration and receive your assessment. If you have overpaid or underpaid, you will receive a refund or a bill for the difference, respectively.

If you fail to pay or file your trade tax on time, you may face penalties, interest charges, or enforcement measures from the local tax office. The penalty for late filing is usually calculated by 0.25% of the assessed trade tax per month (at least a minimum amount of 25 euros per month), up to a maximum of 25% of the assessed trade tax. The surcharge for late payments is usually 1% per month. The enforcement measures may include seizing assets, bank accounts, or wages.

What are some special cases or exemptions for trade tax?

There are some special cases or exemptions for trade tax in Germany, depending on the type of business or activity you are engaged in. Some examples are:

- Freelancers classified as Freiberufler, such as doctors, lawyers, engineers, artists, etc., are not subject to trade tax.

- Agriculture and forestry businesses are also exempt from trade tax.

- Bussinesses like sole trader and partnerships that earn below the exemption threshold of 24,500 euros in profit per year do not have to pay a trade tax.

- Businesses that are exclusively or almost exclusively engaged in the administration of their real property can benefit from an extended trade tax deduction, which means that their income derived from managing their real estate (such as rental income) is exempt from trade tax.

- Corporate shareholders who receive gains from other businesses like corporations can enjoy an exemption from trade tax, depending on their shareholding percentage. In the case of a shareholding of at least 15%, the gains received are fully exempt from trade tax if they were already owned at the beginning of the year.

How do foreign corporations or permanent establishments pay trade tax in Germany?

Foreign businesses with a permanent establishment in Germany are subject to trade tax at the same rate.

The trade tax is based on the adjusted profit for corporation tax, which may include some interest or royalty payments. Dividend incomes or capital gains repatriated to another corporation may benefit from tax exemptions for trade tax purposes.

How do double taxation agreements affect trade tax liability?

Double taxation agreements are treaties between two countries that regulate how one’s income is taxed when working abroad and how you could avoid double taxes. They prevent or reduce the double taxation of cross-border income or profits by allocating taxation rights among countries. Germany has established double tax treaties with over 70 countries, such as France, the UK, the USA, China, and India. However, not all offer tax relief, and businesses must carefully examine each country’s tax system to ensure they won’t be double-taxed.

Fully qualified tax accountant under German law and specialist advisor for international tax law. More than 15 years of professional tax experience.